Even after almost two decades post the stock markets went online, and dematerialisation of shares was introduced, many long-term and certain institutional investors are still holding share certificates in its physical form.

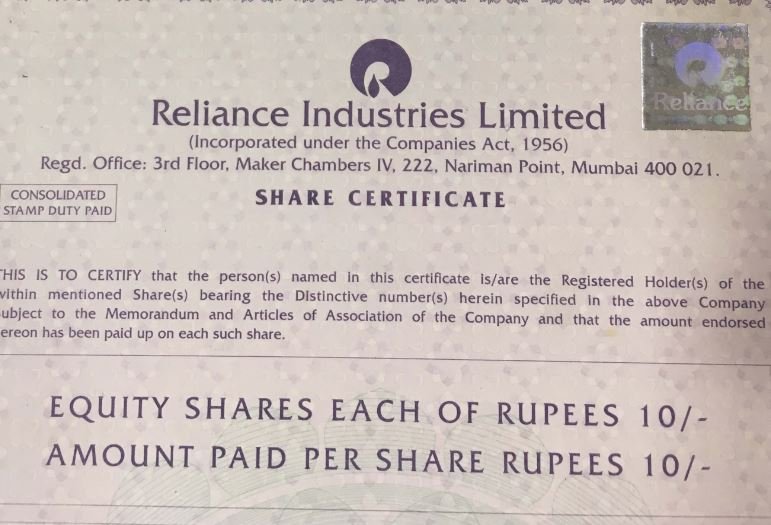

For example, many legacy companies in India such as ITC, JSW Energy, Reliance Industries Limited, HIL, MRF, Sun Pharma and many other public limited companies have not yet dematerialised a large portion of their shares.

For instance, almost 31% of ITC’s share is in physical form, and Reliance Industries Limited is yet to dematerialise shares up to a tune of Rs. 9600 crores. Similarly, many companies have thousands of crores of their shares which are yet to e converted into dematerialised form and still exist in physical share certificate or paper form.

A large number of these shares were issued or purchased prior to the passing of the Depository Act, and as many investors intended to hold on these shares for long terms, and did not wish to pay various fees related to opening and maintaining a demat account, have not converted their physical share certificates into demat form.

But as per latest directive issued by the Securities and Exchange Board of India (SEBI) instructing all shareholders to convert their physical share certificates into dematerialised form by 5th December 2018, which makes it mandatory for shareholders of physical share certificates to convert them into dematerialised form and store or hold them in demat accounts.

How to convert physical share certificates into Demat Form

Many shareholders of physical share certificates can convert their share certificates into dematerialised form by following the steps mentioned below.

1] The opening of a Demat Account

The first step towards converting your physical share certificates into a demat form is the opening of a demat account. A dematerialised account popularly known as a Demat account is a form of account used to hold, trade and transact shares and securities in electronic form.

While trading in stocks and securities online, shares and securities are purchased and held in a Demat account, and thereby facilitating an easy trade for the users.

A Demat account can hold all forms on securities investments such as shares, exchange -funds, bonds government securities, and mutual funds in one single place. Many banks and DPs are now offering free demat account to investors.

You can open a free demat account using the below-mentioned steps.

- You need to contact a Depository Participant, who is registered with SEBI and fill an account opening form.

- You can also approach your bank for opening of a demat.

- Provide your KYC documents along with a filled application form.

- Sign an agreement along with a schedule of charges with the DP/bank. This agreement will provide and mentions the responsibilities and rights of both the account user and the DP.

- You will be provided with a demat account number, and you can start trading in the stock and financial markets using your free demat account.

2] Process of Transferring

Holders of physical share certificates are required to fill a Dematerialization Request Form or a DRF. These DRF forms are easily available with any Depository Participant and the investor also needs to submit their share certificate along with the DRF.

Upon verification of the DRF and the physical share certificate, the investor will receive an electronic request if all physical shares and forms submitted are in order.

Generally, the physical shares are converted into dematerialised form within a period of two-weeks.

3] Dispose of Physical Share Certificates

Physical share certificates need to be stored in a safe and secure manner and they are prone to theft, physical wear and tear, delay in processing, fraudulent transactions, bad delivery and pose several disadvantages when compared with share in demat form.

With conversion of physical share certificates in demat form, investors can safeguard themselves from the above mentioned risk, avoid complex and time consuming processes which have the ability to affect the profitability of your investments.

4] Now Enjoy the benefits of holding shares in dematerialise form in demat account

Even prior to the SEBI’s directive for complete or 100% dematerialisation of shares, many companies and brokers had stopped dealing in physical shares certificates due to the complexity, complex and time consuming process involved while dealing in physical share certificates. Some of the advantages of having shares in dematerialised form are:

Shares can be transferred immediately

Shares can be immediately transferred in the buyers name almost immediately the shares credited in the buyers demat account.

Previously, when shares were held in physical forms as share certificates, original share certificates had to be sent to the registrar or the company to get transferred in name of an individual and this process was used to take weeks and even months.

Also there was a risk of losing share certificate during this process, which has been eliminated by demat accounts.

Easy Holding of Shares.

Demat accounts hold all shares and securities bought from stock exchanges in electronic format in a single account, unlike previously, when people had to sort, file and securely store original share certificates to prevent any form of loss, theft or damage.

Easy divisibility of Shares

Previously, when shares were held in physical form as share certificates, investors were forced to buy, sell and trade shares in marketable lots of 50, 100, 200 shares, which made buying or selling shares in an odd quantity, like 24 shares a very difficult task for investors.

Demat accounts have solved this issue by enabling investors to buy and sell shares in any number of share as they desire.

Now investors can buy, sell or trade shares and securities in any divisible number as desired by an investor and is not restricted to lot size, i.e. now investors can transact even in a single share.

No Stamp Duty Required on Transfer of Securities

Earlier, while physically transferring shares, stamp duty or share transfer stamps had to be pasted below the share certificate. With the introduction of demat account, this has been replaced by the security transaction tax, wherein the entire process of visiting stock exchange to purchase share transfer stamps has been eliminated.

Investors can operate with a single account

Investors can transact in equity instruments, securities, debt instruments like bonds, NCDs, Tax-free bonds etc except debt instruments like bank and company fixed deposits can be held in a single demat account.

Free demat account offered by Many Banks and DPs

Many investors were discouraged to open demat accounts and convert their physical share certificates into demat form due to the various fees and charges associated with opening, maintaining and operating a demat account.

Now, many banks and DPs are offering free demat account to encourage public to invest in the stock and financial markets and aid existing investors to transit from system of using physical share certificates to demat form.